Why Galaxy Digital Purchased Assets Auctioned In Celsius Network’S Bankruptcy

- Posted on December 2, 2022

- News

- By Mark Otto

- 128 Views

Crypto lender Celsius Network is undergoing the auction of its assets as part of the bankruptcy proceedings. The company was affected by the collapse of the Terra (LUNA) ecosystem and hedge fund Three Arrows Capital (3AC).

While Celsius was forced to halt operations, other companies in the industry benefited and found value in the once-prominent lending and custody environment. In that sense, investment firm Galaxy Digital participated in the auction and acquired one of the crypto lender company’s valuable assets, GK8.

Today, @GalaxyHQ, a financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sectors, confirmed their intention to acquire substantially all of the assets, liabilities, and contracts of GK8.

— Celsius (@CelsiusNetwork) December 2, 2022

Galaxy Growths In The Bear Market, Celsius Sells Custody Platform

According to a press release shared with Bitcoinist, Galaxy Digital announced their “intention” to acquire the institutional-grade self-custody platform GK8. A court must approve the purchase before completion as part of the Chapter 11 bankruptcy proceedings.

The release claims that GK8 allows its customers to store their cryptocurrencies with “patented technology” and the “highest possible security.” Users can send transactions without connecting their hardware to the internet to benefit from an extra layer of security.

Galaxy Digital will acquire the company and support its activities while the custody solution is integrated with GalaxyOne. The latter is a new initiative allowing institutions to trade, lend, and access margin-based crypto products.

Galaxy Digital will implement a wide range of custodial options for the new platform. Talking about the acquisition, Mike Novogratz, Founder and CEO of Galaxy Digital said:

The acquisition of GK8 is a crucial cornerstone in our effort to create a truly full-service financial platform for digital assets, ensuring our clients will have the option to store their digital assets at or separate from Galaxy without compromising versatility and functionality. Adding GK8 to our prime offering at this pivotal moment for our industry also highlights our continued willingness to take advantage of strategic opportunities to grow Galaxy in a sustainable manner.

In addition to its products, Galaxy will bring in over 40 people from the custody company and an office in Tel Aviv. The founders of GK8, Lior Lamesh, and Shahar Shamai, will stay at the company’s helm. The founders added:

We are excited by the prospect of joining one of the leading providers of financial and digital asset services to institutions who truly understand the impact of GK8’s custody technology on the future of blockchain. With the backing of Galaxy (…).

In the wake of the collapse of significant crypto companies, the narrative around self-custody is growing stronger. Many prominent figures in the crypto space are asking investors to learn how to remove their assets from exchanges and to practice a form of custody.

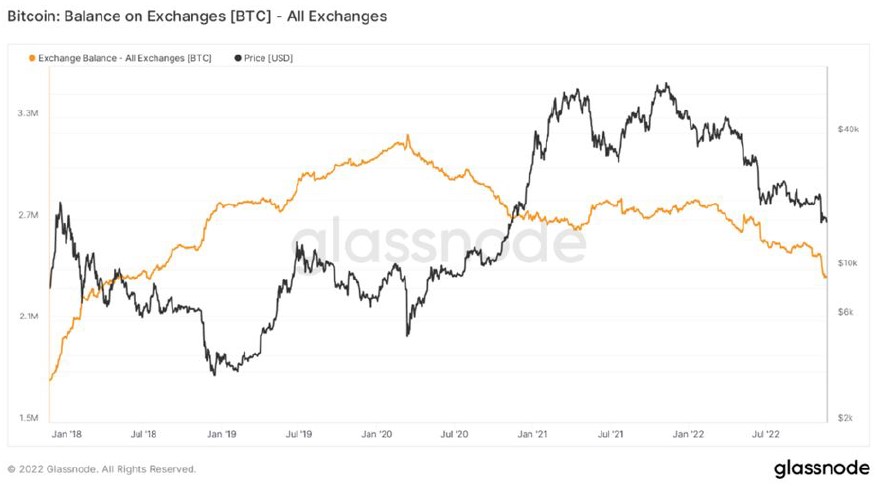

Data from Glassnode indicates that the Bitcoin balance on exchange platforms returned to its 2019 levels. As a result, millions of dollars in digital assets left centralized exchanges over the past month. This downside trend represents a lack of confidence from users in centralized trading venues.

In this environment, self-custody platforms such as GK8 might provide value for Galaxy Digital. In particular, if the lack of confidence in centralized trading venues increases in the long run.

Source: Bitcoinist.com