Why Crypto Could Face “First Real Recession”, Analyst Suggests

- Posted on February 6, 2023

- News

- By Mark Otto

- 192 Views

The crypto market capitalization has been moving in the red over the past few days following an impressive rally. Large digital assets were seeing week after week of profits, but the macroeconomic landscape remains uncertain, capping any upside potential in the short term.

As of this writing, the crypto total market cap stayed above the significant region of $1 trillion recaptured in early 2023. Across the board, digital assets experienced a positive rebound returning to levels last seen in November 2022 when major companies in the sector filed for bankruptcy amid a persistent downside trend.

Looming Recession, Bad News For Crypto?

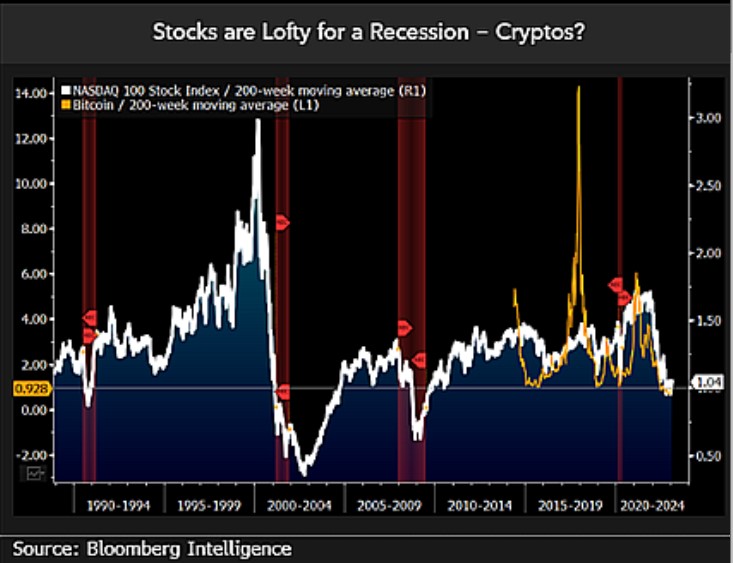

According to a report from Bloomberg Intelligence’s Senior Macro Strategist, Mike McGlone, the U.S. stock market could see further losses over the coming months. Bitcoin and the crypto market have displayed a high correlation with U.S. equities.

In that sense, crypto could follow and re-test its critical support levels if the latter assets trend to the downside. McGlone believes that the “first real recession” for digital assets could usher in an era of “lower asset prices and higher volatility.”

As seen in the chart below, the Nasdaq 100, the U.S. stock index tracking tech equity, is far from reaching its 2008 bottom. At this time, the collapse of the U.S. real state market crashed the world economy, forcing the Nasdaq below its 200-day moving average.

In today’s scenario, as seen in the chart below, the Nasdaq 100 and the crypto market are near a level that has operated as a bottom leading to price appreciation. However, if these levels failed due to macro events, equities, and crypto could crash much lower into their 2008 levels. McGlone wrote:

In 2002 (during the dot com bubble crash) the (Nasdaq) index bottomed at almost 70% below this mean, and about a 40% discount in 2009. We don’t expect the crypto market to be spared if the risk-asset tide continues to recede.

However, if the macroeconomic landscape improves, McGlone expects the nascent industry to “resume beating most equity indexes.” If the crypto market can rebound from these levels or hold support below to resume the rally, investors might see a change in the current regime that will benefit risk-on assets.

Source: NewsBTC