U.S. Is 'Going Big' on Crypto, Treasury Secretary Bessent Says

U.S. Embraces Digital Assets with Regulatory Oversight

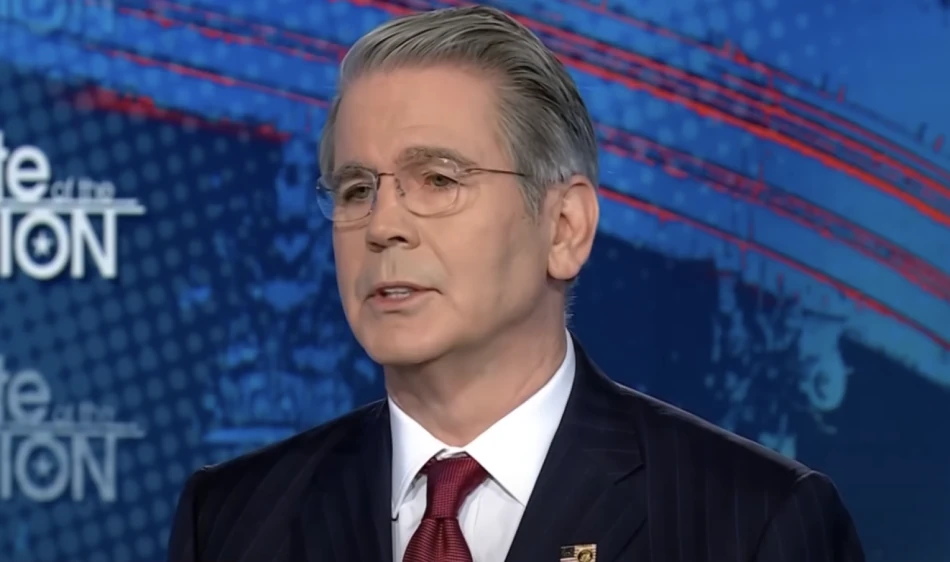

In a recent Bloomberg interview, U.S. Treasury Secretary Scott Bessent announced that the world's largest economy is preparing for a major advancement in digital assets. The administration aims to support cryptocurrency growth while upholding strict regulatory standards, particularly for stablecoins.

"We intend to apply the highest U.S. regulatory AML standards to digital assets, especially stablecoins," Bessent emphasized, underscoring the government's focus on maintaining ecosystem integrity and stability.

Bessent highlighted stablecoins' potential to generate demand for U.S. Treasuries and Treasury bills, projecting a possible surge to $2 trillion in the short term from the current $300 billion level.

The U.S. Senate is expected to advance stablecoin legislation soon, a significant milestone for the industry. Major financial institutions like Fidelity and JPMorgan are reportedly considering entering the stablecoin market, reinforcing the government's commitment to digital assets.

Beyond stablecoins, the administration is also supporting Bitcoin adoption. In March, the U.S. made history by creating a strategic Bitcoin reserve, and Bessent has indicated interest in acquiring additional forfeited coins.

With robust regulatory oversight and strategic digital asset investments, the U.S. is positioning itself as a key player in shaping cryptocurrency's future.

Most Viewed News