These Altcoins Could Be Ones To Watch For, Santiment Suggests

- Posted on January 27, 2023

- News

- By Mark Otto

- 170 Views

Data from Santiment shows these altcoins have seen elevated whale activity recently, which may make them ones to watch for in the coming days.

Polygon (MATIC), Aave (AAVE), And Dydx (DYDX) See Increased Whale Transactions

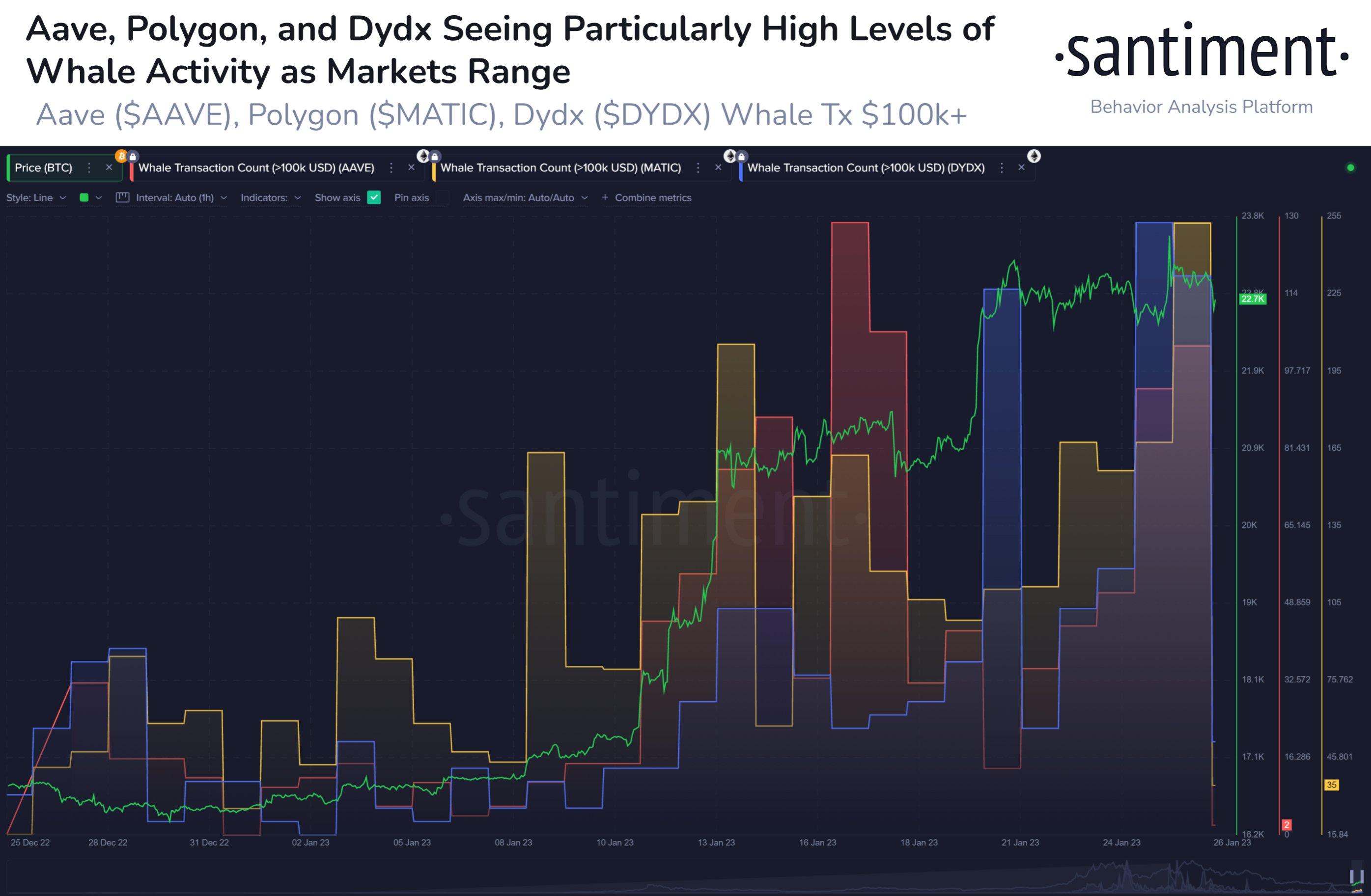

According to data from the on-chain analytics firm Santiment, Polygon, Aave, and Dydx have all rallied along with high whale activity recently. The relevant indicator here is the “whale transaction count,” which measures the total number of transfers that whales are making right now.

In the context of these altcoins, the condition for a transaction to count as one coming from whales is that it should involve a movement of coins worth at least $100,000.

When the value of this metric is high for any coin, it means whales are making a large number of transactions of that particular crypto currently. This trend suggests these humongous holders are actively trading the specific coin at the moment.

Since whale transactions involve the movement of large scales of capital, a significant number of them together can sometimes noticeably impact the market. Because of this, the whale transaction count being at sizeable values can result in increased volatility in the price of the crypto in question.

Now, here is a chart that shows the trend in the whale transaction count for three different altcoins (Polygon, Aave, and Dydx) over the past month:

As displayed in the above graph, Polygon, Aave, and Dydx have all observed some pretty high whale activity during the past month. In this period, these altcoins have also shown some significant rallies (AAVE has climbed 56%, MATIC 35%, and DYDX 94%).

Interestingly, the most significant spikes in the whale transaction count for these cryptos came when the market was ranging (as can be seen from the BTC price curve in the above graph) between January 13 and January 18. Following this extraordinary burst of activity, the rally (which had come to a temporary halt) resumed its momentum and the altcoins sharply increased in their value.

In the last few days, the indicator’s values have again been at similar (if not outright higher) levels as seen during the aforementioned elevated whale activity period earlier in the month. As was the case last time around, the prices are curiously ranging right now as well.

While high whale transaction counts can be both bearish or bullish for the prices of these coins (since the elevated activity alone doesn’t tell us if the transfers are being done for buying or selling purposes), the fact that the current pattern is similar to that earlier in the month, when high activity from this cohort was in fact bullish, could imply the odds may be in the favor of these altcoins.

Either way, as Santiment suggests, “the increased large address interest in these assets should be watched closely.”

MATIC Price

At the time of writing, Polygon is trading around $1.0955, up 14% in the last week.

Source: Bitcoinist.com