Terra And Do Kwon Lawsuit Voluntarily Dismissed, But Why?

- Posted on January 10, 2023

- News

- By Mark Otto

- 167 Views

The plaintiffs in a class action lawsuit against TerraUSD and its affiliated companies voluntarily dismissed their case on Monday.

Matthew Albright filed the lawsuit on behalf of others against Terraform Labs (TFL), Pte Limited, and other affiliates in the Southern District of New York Court in August 2022.

The plaintiffs alleged that the defendants falsely promoted, manipulated, and offered UST stablecoin and LUNA. Zhu Su, a cofounder of failed crypto hedge fund Three Arrows Capital (3AC), announced the voluntary dismissal of the class action lawsuit via a tweet on January 10.

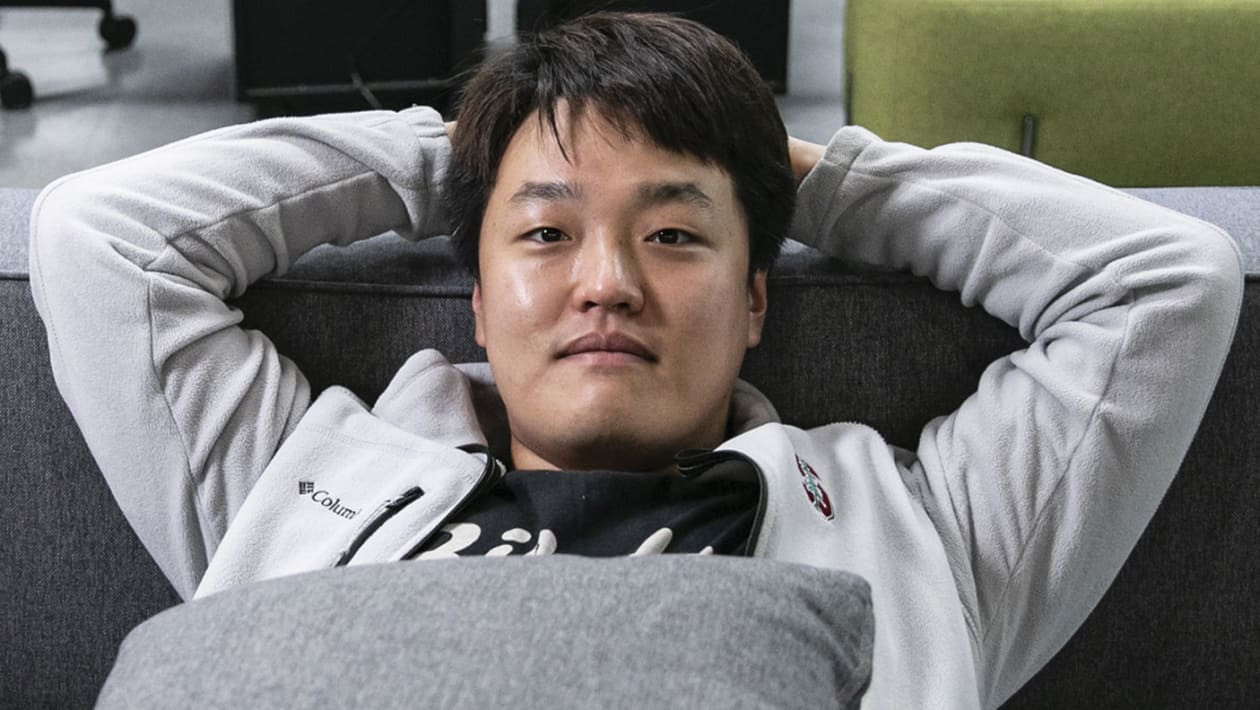

Matthew Albright, the lead plaintiff in the case, filed a notice in Court stating a voluntary dismissal of the case against the defendants. The defendants include Terraform Labs, Do Kwon, Delphi Digital Consulting, Luna Foundation Guard (LFG), Jump Trading, Nicholas Platias, and three others.

Albright and his co-plaintiffs accused TerraUSD and the other defendants of falsely promoting UST, LUNA, and other related coins. According to the lawsuit, the defendants falsely projected the coins’ stability while laundering the profits from Terraform Labs into personal accounts.

3AC Blames FTX For TerraUSD’s Fallout

The lawsuit could be linked to the November tweets by 3AC’s cofounder Zhu Su that FTX and Alameda Research manipulated the crypto market. Zhu claimed that FTX was part of a conspiracy that resulted in the UST collapse.

Three Arrows Capital got hit badly by the crisis and went bankrupt shortly after due to severe exposure to Terraform Labs. Zhu Su and TerraUSD’s founder, Do Kwon, previously blamed Genesis and Alameda Research for UST and LUNA’s crash.

Nonetheless, TerraUSD and its affiliates also faced two other class action cases, which are still active. Bragar Eagle and Squire, P.C. law firm, and Scott + Scott, a securities and consumer rights litigation firm, filed the lawsuits.

Primary Cause Of TerraUSD Collapse, Was It A Hack?

Meanwhile, investigations on collapse remain ongoing. In a December 6 tweet, FatmanTerra alleged that TFL’s claims that UST recorded a hack attack are false. FatmanTerra, is an integral part of the puzzle in TerraUSD collapse, and its been reporting on the firm’s collapse for over a year. The Twitter user has been helping the crypto community to bring the founder of TerraUSD to justice.

According to Fatman’s tweet, Terraform Labs dumped over $450 million UST on the open market a few days before the implosion.

Fatman cited data from Cycle_22, an anonymous researcher who discovered Hodlnaut, a Singapore-based crypto lender’s insolvency. The data revealed that TFL started dumping millions of UST a few days before the depeg.

According to Fatman, dumping such an amount of UST within that short period reduced the stablecoin’s liquidity and weakened its peg.

The UST dump and the $2.7 billion removed by TFL through Degenbox contributed to the implosion. Fatman implied that Do Kwon and Terraform Labs withdrew real dollars from the ecosystem, making UST redemption impossible.

More so, the independent audit released by TFL and Luna Foundation Guard (LFG) to show its efforts in redeeming the UST peg were incomplete. According to the Twitter user, the audit did not account for the 47,000BTC sent to Jump Crypto by the LFG.

This revelation further increased the evidence against TFL and Do Kwon, who remains on the run from South Korean prosecutors.

Meanwhile, LUNA witnessed a 12.79% price surge in the past 24 hours and trades at $1.56. LUNA’s price rally happened during the ongoing developments on the 2.0 chain.

Jared from TFL revealed, via a tweet, that the current version of TerraUSD Station undergoes an automatic update, which is incompatible with the Classic. Jared told the Station users on Classic that an update to Station will occur on January 10, 2023. Cover image from Pixabay, LUNA chart from Tradingview.

Source: Bitcoinist.com