SBF Launches Substack, How Much Is He Charging Per Year?

- Posted on January 12, 2023

- News

- By Mark Otto

- 132 Views

FTX founder Sam Bankman-Fried (SBF) reappeared on Substack on Thursday and repeated that he did not “steal funds” in what seemed to be an outline of his legal case. SBF, currently unemployed and under house arrest, has done what seemed like the next natural step: he created a Substack newsletter and charged people $80 a year to subscribe.

In the first post of the aptly-called “SBF’s Substack,” the disgraced former FTX CEO blamed the failure of the cryptocurrency exchange’s subsidiary company Alameda Research on Changpeng Zhao ‘CZ,’ the CEO of Binance.

An extreme, quick, targeted crash precipitated by the CEO of Binance made Alameda insolvent,” SBF added that FTX was affected by the Alameda virus. “and other places.

The two chiefs of the crypto industry have openly sparred over CZ’s part in the FTX issue, which at one time involved a rescue proposal that was ultimately scrapped.

According to SBF’s report on Substack, CZ had conducted an “extremely successful months-long PR campaign against FTX” before the crucial week or so in November that resulted in the exchange’s bankruptcy.

“I didn’t steal funds, and I certainly didn’t stash billions away,” SBF wrote.

In December, federal authorities detained SBF, but he was released on a record-breaking $250 million bond. However, he has been under the custody of his parents at their Palo Alto home in California.

Related Reading: Huge Crypto Dump Incoming As FTX Plans To Sell Altcoins Worth $4.6B

The FTX founder is prohibited by the terms of his bail from establishing any new lines of credit, forming a business, or engaging in any financial transactions greater than $1,000 without obtaining the necessary government or court permission. Therefore, it appears that he will not be able to monetize his Substack anytime soon.

No Funds Were Stolen, SBF Said in Substack

In his first post, SBF also covered other details about FTX’s bankruptcy. He claimed there had been no criminality, contrasting the liquidity issue that brought down FTX’s sibling company Alameda Research with other prominent crypto crashes last year.

“Alameda lost money due to a market crash it was not adequately hedged for–as Three Arrows and others have this year. And FTX was impacted, as Voyager and others were earlier.”

Although SBF stated in the post that he had not been in charge of Alameda for a while, Caroline Ellison, the company’s former CEO, was not explicitly mentioned. In an apparent agreement to assist law enforcement in their probe into FTX—and SBF—Ellison entered a guilty plea to fraud charges in December with the co-founder of FTX, Gary Wang.

Despite the allegations of fraud he is fighting, it looks like SBF plans to keep blogging

I have a lot more to say–about why Alameda failed to hedge, what happened with FTX US, what led to the Chapter 11 process, S&C, and more. But at least this is a start.

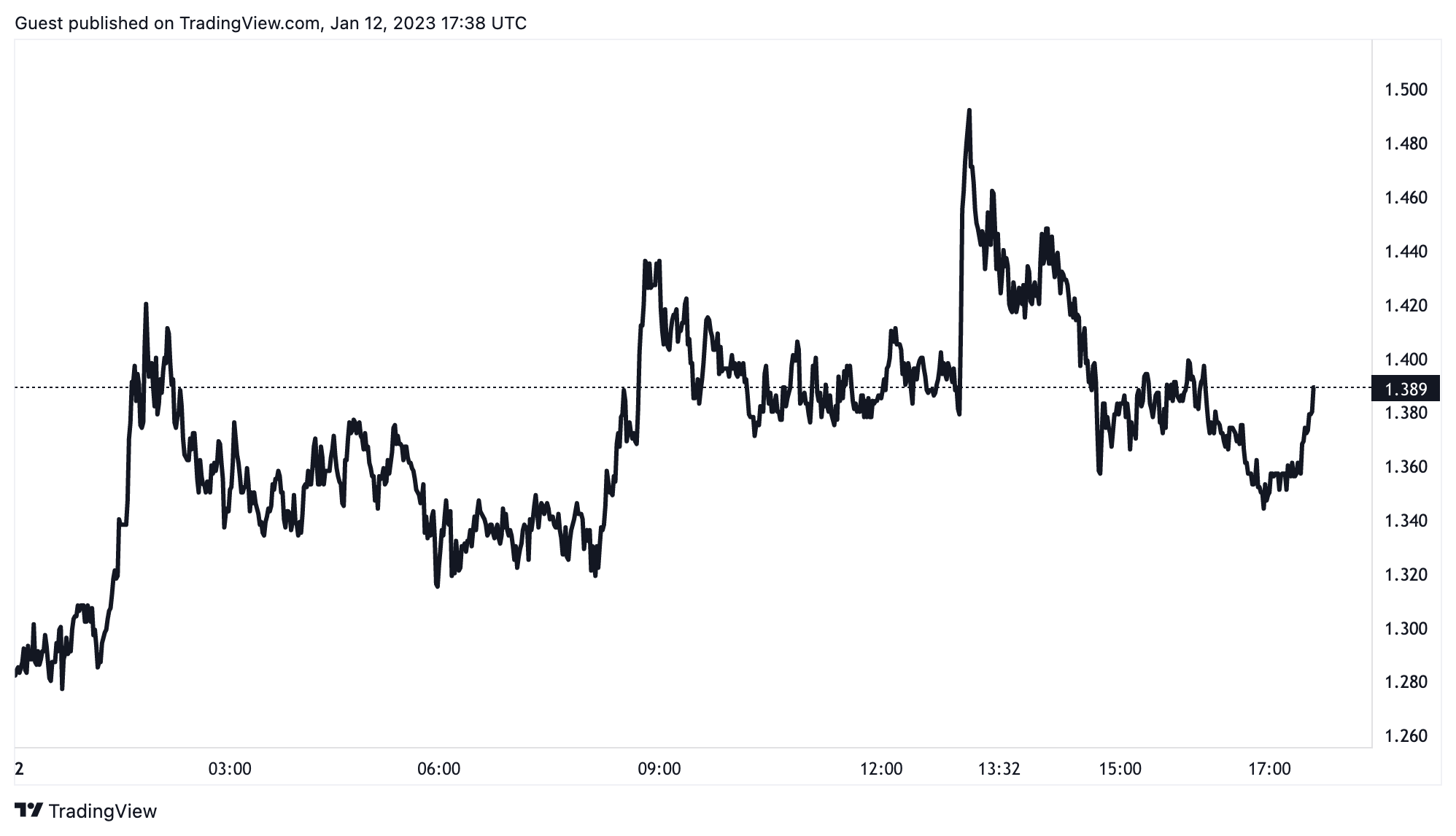

Amid the ongoing scandal from recent months, the price of the FTT token appears shaky. The token’s value has dropped by approximately 95% since the exchange filed for bankruptcy, from a high of $28 to its current value of $1.38 at the time of writing, with no chance of ever rebounding.

Cover image from the New York Post. FTTUSDT chart from Tradingview.

Source: Bitcoinist.com