Robert Kiyosaki Predicts Bitcoin Soar to $1M as Looming Economic Crash Approaches

Renowned financial expert Kiyosaki doubles down on his $1 million Bitcoin price prediction[...]

Kiyosaki Predicts Bitcoin Surge to $1 Million as Economic Collapse Looms

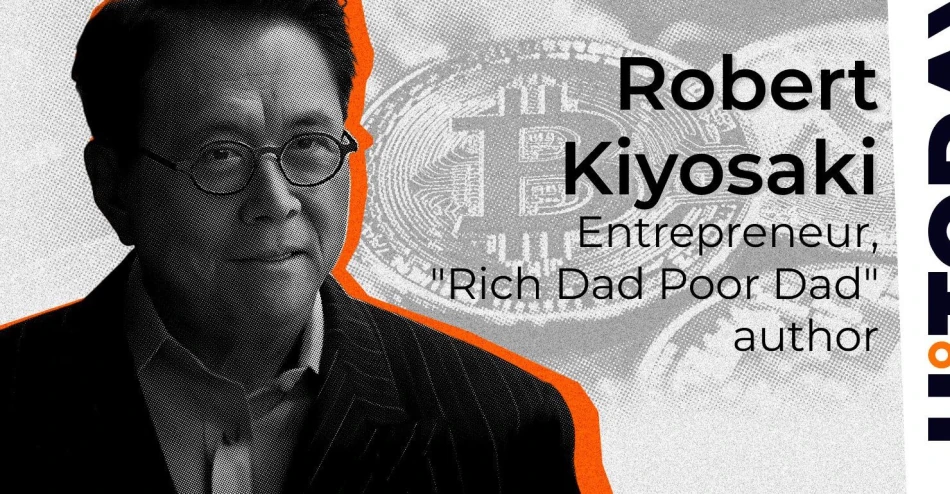

Robert Kiyosaki, the renowned author of the best-selling book "Rich Dad Poor Dad," has made a bold prediction: the greatest financial collapse in history has already begun, and as a result, he believes that the price of Bitcoin will skyrocket to $1 million per coin over the next decade.

In a recent interview with Brian Rose, the founder and host of Real London TV, Kiyosaki expressed his concerns about the current state of the economy. He believes that the Federal Reserve and the U.S. Treasury are "running a criminal enterprise" by "printing worthless money to cover up a collapsing system." Kiyosaki's message is clear: it's time to get out of fiat currency, stocks, and bonds, and instead invest in what he considers to be real assets – Bitcoin, gold, and silver.

According to Kiyosaki, the market crash has already begun, and billions of people are at risk of being wiped out financially. He predicts that over the next ten years:

- Bitcoin will reach $1 million per coin

- Gold will climb to $30,000 per ounce

- Silver will triple in value from its current $35 price level

Kiyosaki's views have been gaining traction in the mainstream media, and he believes that more and more people in the U.S. are starting to realize that something is wrong with the economy. He argues that it doesn't take an economist to feel the tension in the air.

In the interview, Kiyosaki also addressed the fast-growing U.S. national debt, which has been a source of concern for many. He has been actively urging his followers on X (formerly known as Twitter) to vote against the Republican party's new tax-and-spending package, which is likely to increase the national debt by another $5 trillion.

Kiyosaki's bold predictions and his calls to action have resonated with many, particularly in the cryptocurrency community. As the economic landscape continues to evolve, it will be interesting to see whether his predictions come to fruition and how investors respond to his advice.

Most Viewed News