Renowned Short Seller Criticizes Bitcoin Advocate Saylor's 'Financial Gibberish'

Jim Chanos has lambasted Bitcoin advocate Saylor for promoting financial gibberish[...]

Crypto Heavyweight Chanos Battles Saylor Over MicroStrategy's Bitcoin Bet

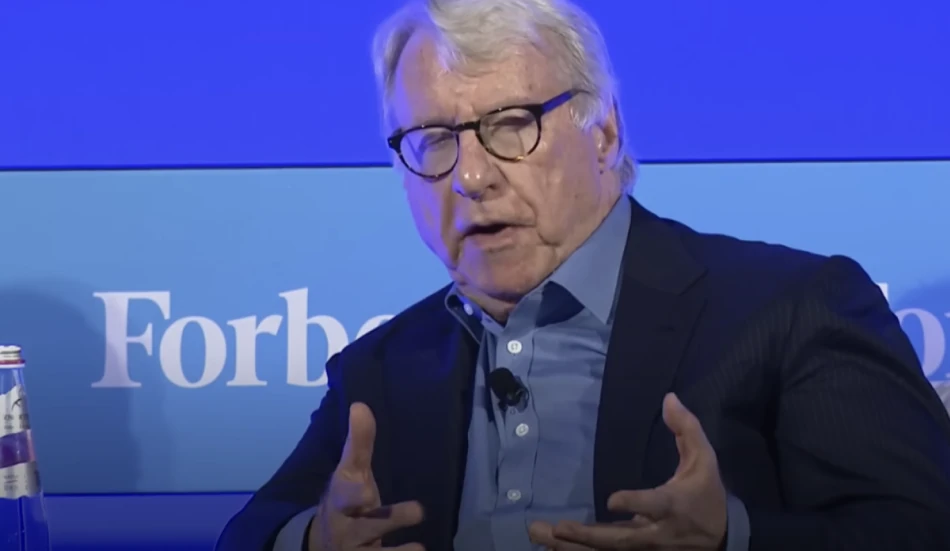

Short Seller Chanos Slams Saylor's "Financial Gibberish"

Legendary short-seller Jim Chanos has launched a scathing attack on MicroStrategy founder Michael Saylor, accusing him of promoting "complete financial gibberish" in his justification of the company's Bitcoin (BTC) holdings. Chanos believes that valuing MicroStrategy based on changes in the net asset value (NAV) of its Bitcoin stash is absurd, calling it a blatant attempt to mislead investors.

Saylor Fires Back, Defends MicroStrategy's Bitcoin-Backed Financing

In response, Saylor has questioned whether Chanos truly understands MicroStrategy's business model. He stressed that the company is the largest issuer of Bitcoin-backed credit instruments globally, with its Bitcoin purchases being funded through preferred stock offerings rather than common stock. Saylor warned that Chanos could end up getting liquidated if MicroStrategy's stock price rallies.

Analysts Grapple with Valuing MicroStrategy's Crypto-Centric Approach

Those attempting to value MicroStrategy must consider the company's ability to generate yield from its Bitcoin holdings, a factor that may not be fully appreciated by traditional short-sellers like Chanos. The ongoing battle between these crypto heavyweights highlights the complexities involved in assessing the merits of a company's digital asset-focused strategy.

Broader Implications for the Crypto Ecosystem

The clash between Chanos and Saylor resonates across the broader crypto landscape, as it underscores the divergent views on the role of digital assets in corporate finance. As the industry continues to evolve, the ability to effectively evaluate and communicate the value proposition of crypto-centric business models will be crucial for both investors and industry participants.

Most Viewed News