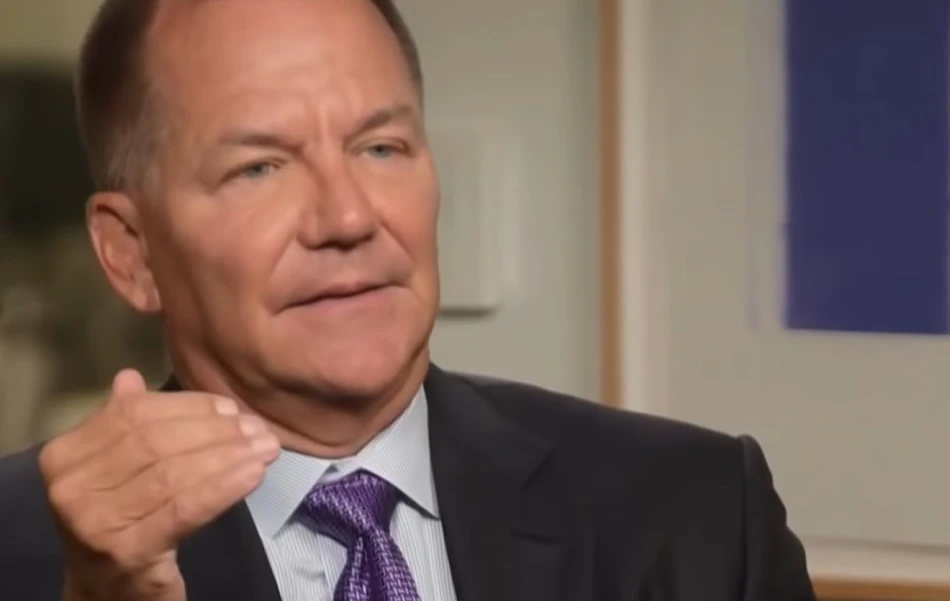

Renowned Investor Paul Tudor Jones Touts Bitcoin as Essential Portfolio Allocation

Paul Tudor Jones has warned that the U.S. government will use inflation and low interest rates to get out of the debt problem[...]

Crypto Titan Touts Inflation-Hedging Portfolio: Bitcoin, Gold, and Stocks

Paul Tudor Jones Advocates Volatility-Adjusted Crypto-Infused Investments

In a recent Bloomberg interview, legendary hedge fund manager Paul Tudor Jones made a bold case for a unique portfolio strategy to combat inflation. The renowned investor, known for his accurate market predictions, suggested a balanced mix of Bitcoin, gold, and stocks could serve as an optimal hedge against current economic challenges.

Doubling Down on Bitcoin

Jones reiterated his longstanding recommendation to allocate 1-2% of portfolios to Bitcoin, a position he first took in 2020 during pandemic-driven market volatility. The billionaire maintains that cryptocurrency has grown increasingly relevant as policymakers grapple with debt management while passing financial burdens to consumers through low real rates and persistent inflation.

Policymakers' Dilemma and the Crypto Hedge

Jones argues that current economic conditions enhance Bitcoin's appeal as a protective asset against central bank policy consequences. He suggests that as governments implement measures like increased taxation to address debt, investors should consider diversified portfolios featuring Bitcoin, gold, and equities for protection.

AI: The Next Disruptive Force

In a striking aside, Jones warned about artificial intelligence's potential risks, suggesting the technology could pose an existential threat. This dramatic prediction highlights his view that AI's transformative impact will be a dominant factor in coming years.

As cryptocurrency markets face regulatory uncertainty and economic fluctuations, Paul Tudor Jones' endorsement of Bitcoin-inclusive investment strategies carries substantial credibility. The hedge fund veteran's track record of identifying and capitalizing on emerging trends makes his current recommendations particularly noteworthy for investors navigating today's complex financial landscape.

Most Viewed News