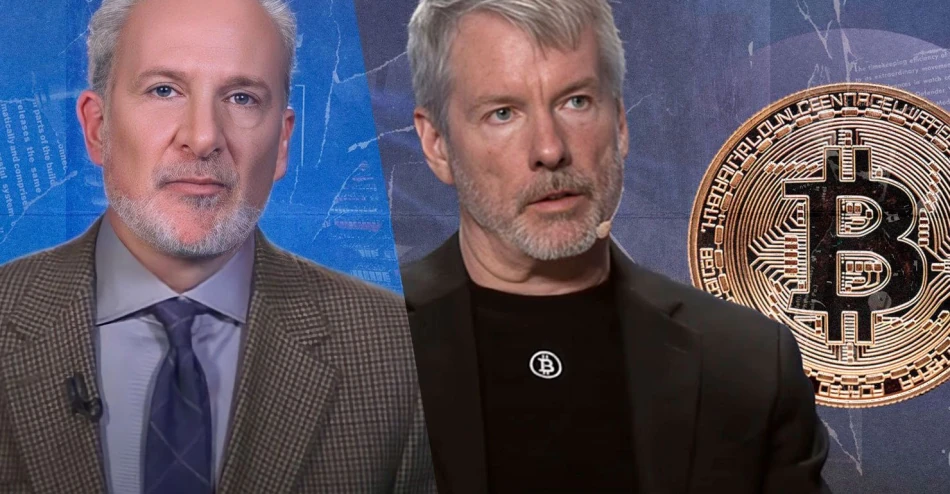

Experts Debate Saylor's Billion-Dollar Bitcoin Strategy: Fraud or Visionary Move?

Schiff slams Saylor's Bitcoin strategy as "complete fraud," Here's why[...]

Michael Saylor's Bitcoin Bet: Brilliant Strategy or Risky Gamble?

Crypto Skeptic Peter Schiff Doubles Down on Criticism of MicroStrategy's Bitcoin Holdings

Renowned gold advocate and Bitcoin critic Peter Schiff has renewed his attack on MicroStrategy's massive Bitcoin investment, calling it a "complete fraud" that could potentially bankrupt the company. This criticism follows MicroStrategy's recent disclosure of accumulating 582,000 BTC, valued at over $62.6 billion, positioning the company as one of the largest corporate Bitcoin holders worldwide.

A Precarious Balance Sheet?

While MicroStrategy currently enjoys an impressive 53.65% unrealized gain on its Bitcoin holdings with an average cost basis around $70,000 per BTC, Schiff warns the strategy is fundamentally flawed. He argues that if Bitcoin's price falls below the company's cost basis, losses could escalate rapidly - especially considering a significant portion of these holdings were acquired using borrowed funds.

Schiff's concerns extend beyond price volatility. He suggests MicroStrategy's entire market valuation of approximately $108.1 billion is dangerously tied to its Bitcoin assets. This dual dependency means any significant decline in either BTC's price or MicroStrategy's stock value could severely strain the company's financial position.

Saylor Remains Unfazed, but Skeptics See Trouble Ahead

Despite mounting criticism, MicroStrategy CEO Michael Saylor continues to stand by his "Bitcoin forever" philosophy. However, critics like Schiff view the company's aggressive Bitcoin accumulation as more of a high-stakes gamble than a strategic investment.

As cryptocurrency markets face ongoing uncertainty, the debate surrounding MicroStrategy's unconventional strategy shows no signs of cooling. Market observers will be watching closely to see whether Saylor's bold bet ultimately succeeds or if Schiff's warnings about potential financial instability prove accurate.

Most Viewed News