Bitcoin Mining Difficulty Observes Sharpest Drop Since China Ban

- Posted on December 7, 2022

- News

- By Mark Otto

- 152 Views

Data shows the Bitcoin mining difficulty has just observed its sharpest plunge since the aftermath of the China ban.

Bitcoin Mining Difficulty Sees Largest Downwards Adjustment Since July 2021

As per data from on-chain analytics firm Glassnode, the BTC difficulty has gone down by 7.3% in the latest adjustment on the blockchain.

To understand the concept of mining difficulty, the “hashrate” needs to be looked at first. The hashrate is a measure of the total amount of computing power currently connected to the Bitcoin network.

Whenever this metric goes up, it means miners are connecting more mining machines to the blockchain right now. On the other hand, a decrease implies they are taking some of their rigs offline at the moment.

As the hashrate fluctuates up and down like this, so does the miners’ ability to handle transactions on the network. An increase means miners can hash blocks faster thanks to the extra power, while a decline suggests the opposite.

However, one feature of the Bitcoin blockchain is that it tries to keep the rate at which miners hash blocks almost constant. Obviously, changes in the hashrate takes this rate away from the network’s standard.

So, to counteract such fluctuations, the network adjusts what’s called the “mining difficulty.” This metric defines how hard chain validators will find to mine Bitcoin.

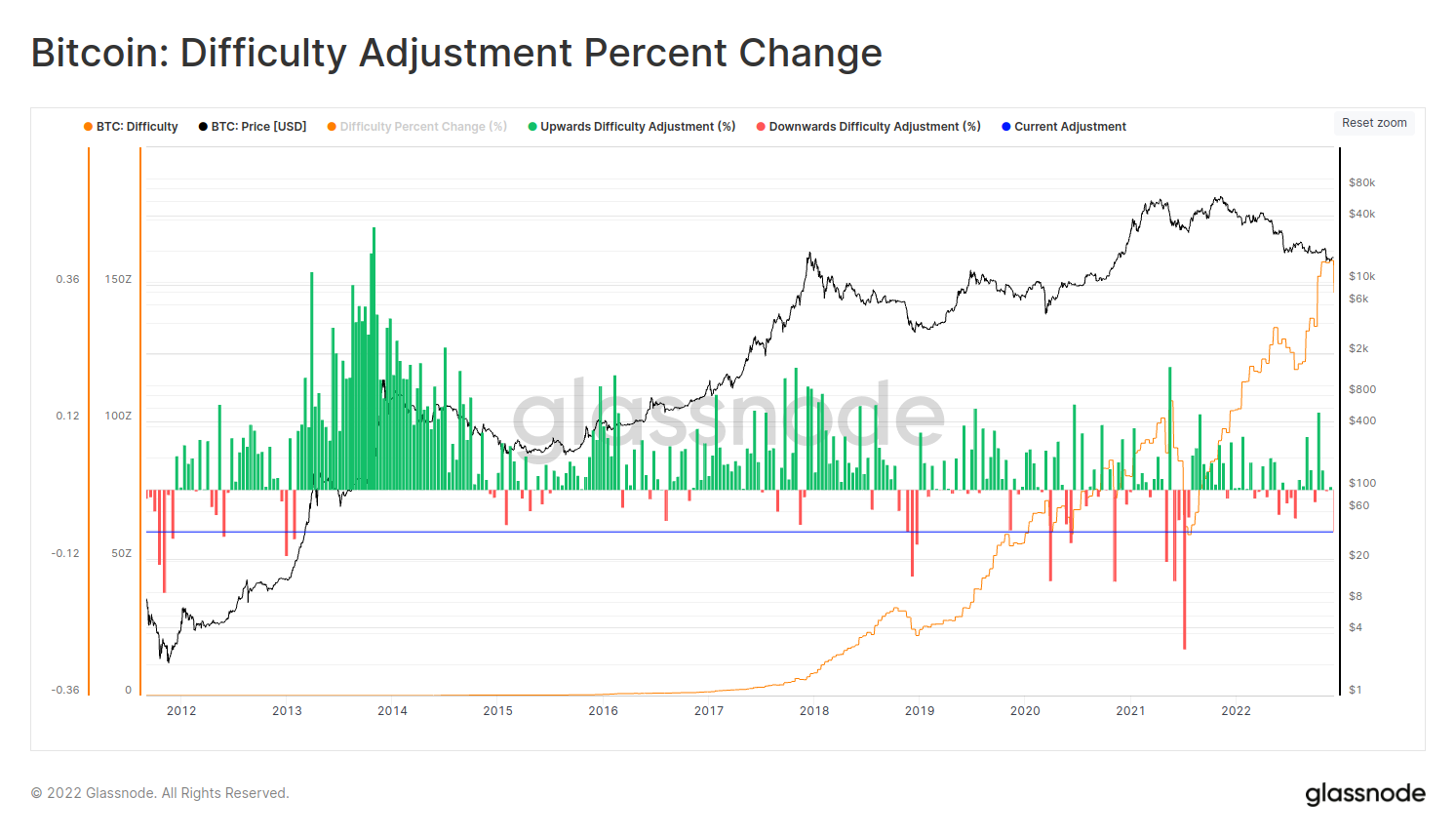

Here is a chart that shows how the BTC difficulty has changed over the years:

As you can see in the above graph, the Bitcoin mining difficulty was at an all-time high just recently.

This was because the hashrate was also floating around ATH levels so the network had to step up the difficulty to slow down the miners to the desired rate.

However, miners had already been struggling hard due to the hash bear market so the extra difficulty meant that it was no longer profitable to mine BTC for some of them.

Such miners then started disconnecting from the network in hordes, tanking the hashrate. It’s this recent sharp decline in the metric that has also lead to a significant drop of 7.3% in the mining difficulty.

This latest sharp downwards difficulty adjustment is the highest on the Bitcoin chain since July 2021, when the hashrate collapsed in the aftermath of China’s ban on mining.

BTC Price

At the time of writing, Bitcoin’s price floats around $16.9k, up 3% in the last week. Over the past month, the crypto has lost 20% in value.

Source: Bitcoinist.com